Bitcoin mining is an incredibly competitive industry, and miners are always searching for profitable, safe and sustainable hosting opportunities. The most popular options offered by hosting facilities are the profit sharing and embedded fee models. Both have their advantages and disadvantages, and choosing the right one depends on several factors, including the upcoming halving event.

The embedded fee hosting model is currently the most popular in the industry. In this model, the hosting facility charges an OpEx (operational) fee per unit for hosting the equipment and a flat electricity rate, regardless of the efficiency of the equipment or the price of Bitcoin. This rate typically embeds the facility’s electricity cost as well as their overhead. One advantage of this model is that it provides miners with more stability and predictability in their costs and yields the highest returns when Bitcoin is in a raging bull market. However, the fixed fee can also eat into profits if the price of Bitcoin falls or the difficulty of mining increases, as we have been experiencing as of late. It is important to note that with this model, the hosting facility has no vested interest in the profitability or sustainability of the miner.

The profit sharing model is another option offered by hosting facilities. In this model, the hosting facility takes a percentage of the profits generated as a fee, typically ranging from ratios of 80:20 to 50:50 split between the host and the miner depending on the miners hosted. This means that the miner earns a larger share of profits if they have more efficient mining equipment. One advantage of this model is that miners do not need to worry about fixed costs and can adjust their mining operations based on market conditions. It is vital to note that with this model, the hosting facility has a vested interest in the profitability and sustainability of the miner, since they share in the profits generated by the equipment. The hosting facility has an incentive to provide the miner with a reliable and efficient hosting service that maximizes their profitability. In this way, the profit sharing model can create a mutually beneficial relationship between the miner and the hosting facility, with both parties working together to achieve long-term profitability and sustainability. Additionally, the profit sharing model provides greater transparency and accountability in the mining process, as the hosting facility shares the actual cost of electricity and revenues with the miner, reducing the risk of fraud and increasing trust between all parties involved.

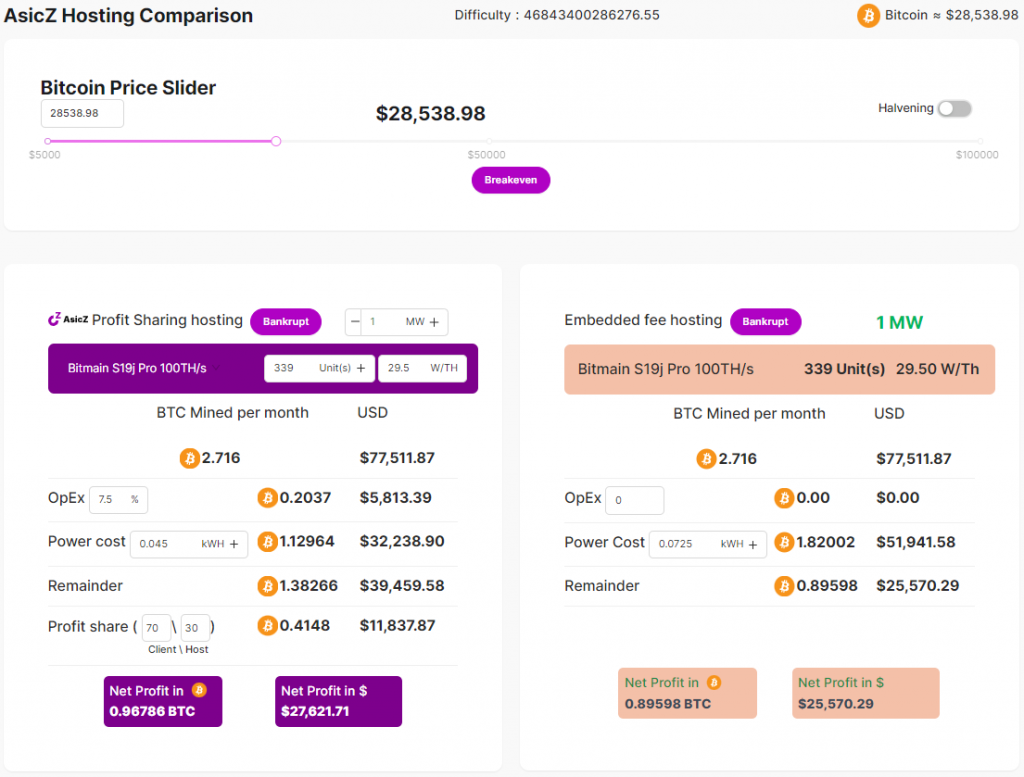

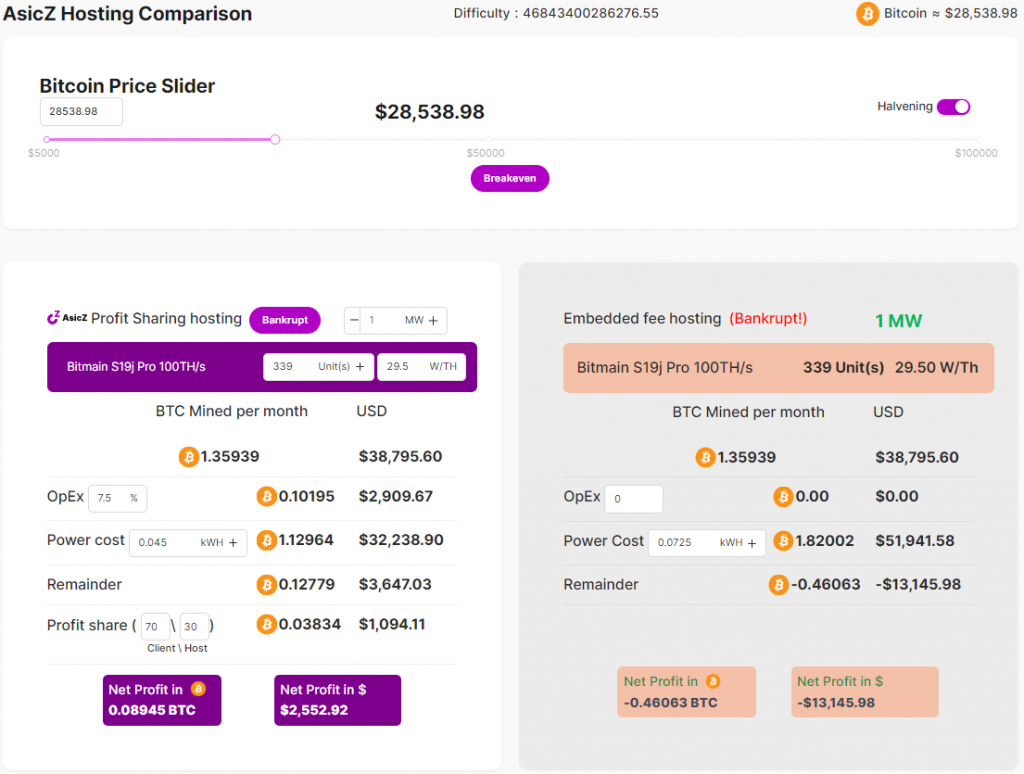

Profitability calculators are used by miners to estimate their revenues and calculate profits based on their equipment. However, there aren’t any calculators that take hosting or the BTC halvening into account. This event, which occurs approximately every four years cuts the block reward in half. This means that miners will receive 50% less Bitcoin for each block they mine. This decrease in rewards can significantly affect a miner’s profitability, particularly if the price of Bitcoin falls or the difficulty of mining increases. With the next halvening only a year away, this is essential information for miners to understand and plan accordingly. AsicZ’s hosting comparison app is the only known technology in the industry to provide an intuitive calculation before and after the halvening for both the profit sharing and embedded fee hosting models. You can easily find the number of units per miner model required per MW (or KW), input the OpEx, power cost and Bitcoin price to output the profits in BTC and USD. You can even find a breakeven price between the two models and see where each model becomes unprofitable. Below are two screenshots of the app showing a before and after halvening comparison of profits at the current Bitcoin price and difficulty.

As can be seen above, the profitability decreases significantly after the halving event. This means that many miners, especially those using embedded fee hosting may find it difficult to remain sustainable at current prices, even with a competitive power cost. On the other hand, the profit sharing model remains profitable even after the halving event at current prices as the hosting facility shares in the lower profitability.

One real-world example of the impact of the halving event can be seen in the case of the leading miner manufacturer, Bitmain. After the 2016 halving event, Bitmain saw a significant decrease in profitability, with their revenue dropping from $320 million to $260 million. This decrease in revenue was attributed to a lack of miner sales due to the halvening in block rewards. Another example is the case of the mining firm Hut 8. After the 2020 halving event, Hut 8’s revenue dropped by 42%, from CAD 19.4 million in Q1 2020 to CAD 11.2 million in Q1 2021.

As the halving event approaches, many miners are considering their options and evaluating their costs to determine the most profitable way to mine Bitcoin. The embedded fee hosting model may have been more popular in the past, but the upcoming halving event will lead many to reconsider options and look for more flexible and cost-effective models like profit sharing. This model allows miners to focus on what they do best – mining Bitcoin. Since the hosting facility takes care of the logistics and maintenance of the mining equipment, miners can focus on upgrades and expansion.

If you would like to learn more about AsicZ’s hosting comparison app, please visit AsicZ.com/asiczhosting and create an account. Once your account is created, navigate to Hosting Directory from the top menu and you will see a button for the Hosting Comparison app to access the calculator. Feel free to email us with any questions or feedback at team@asicz.com.