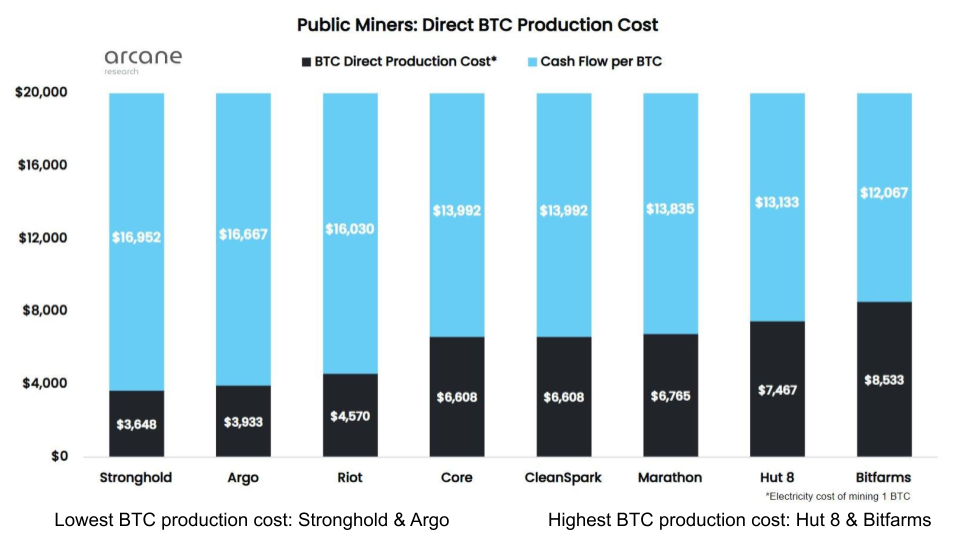

Taking a look at the direct BTC production cost across the board, we find that Sronghold & Argo have the lowest BTC production cost whereas Hut8 and Bitfarms have the highest production cost in comparison.

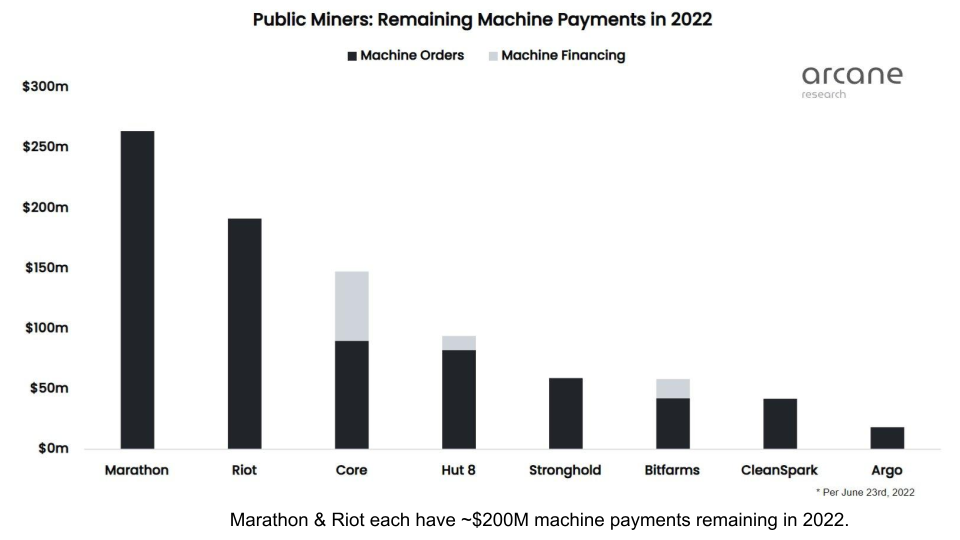

Taking a look at the remaining machine payments in 2022, we can see that Marathon & Riot each have about $200M in machine payments remaining this year. Core and Hut8 have about $100M payments remaining, which is partially financed as well. It’s important to note that Argo has the lowest liability towards machine payments this year.

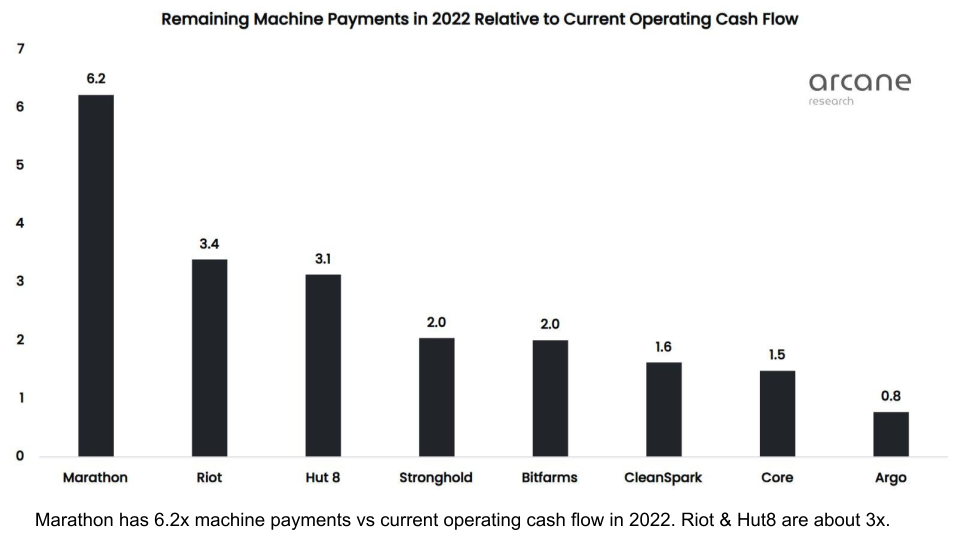

Now we can compare the ratio of machine payments to current operating cash flows for these public miners. Here we find that Marathon, Riot & Hut8 all have 3x more machine payments due in comparison to their current operating cash flows in 2022, which can force them to scale or cut back on expansion opportunities this year. On the other hand, Core, Cleanspark and Argo are in a much better position and should be able to continue scaling their operations as per their machine orders.

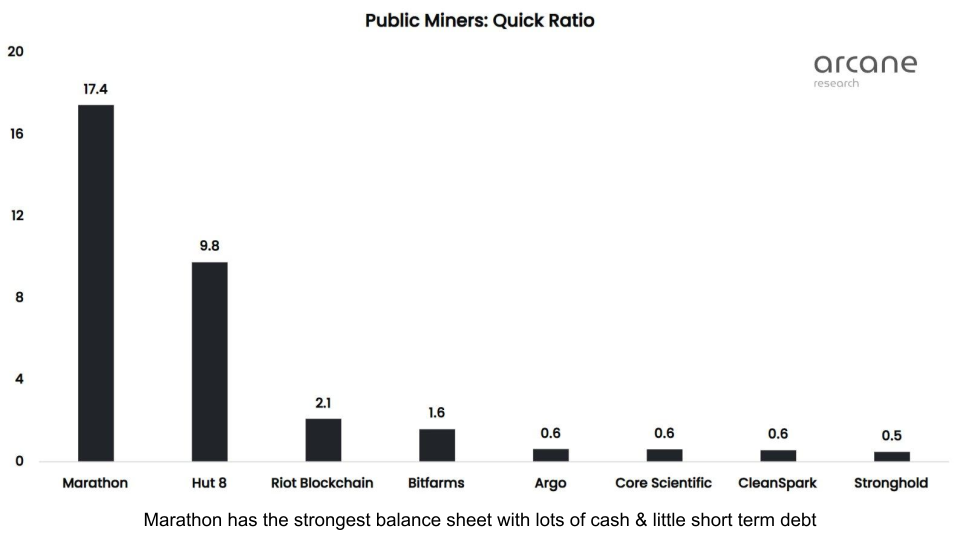

However, in terms of their balance sheet, we find that Marathon and Hut8 have a lot of liquid cash and very minimal short term debts which should allow them to pull through the bear market and come out stronger during the next bull market.

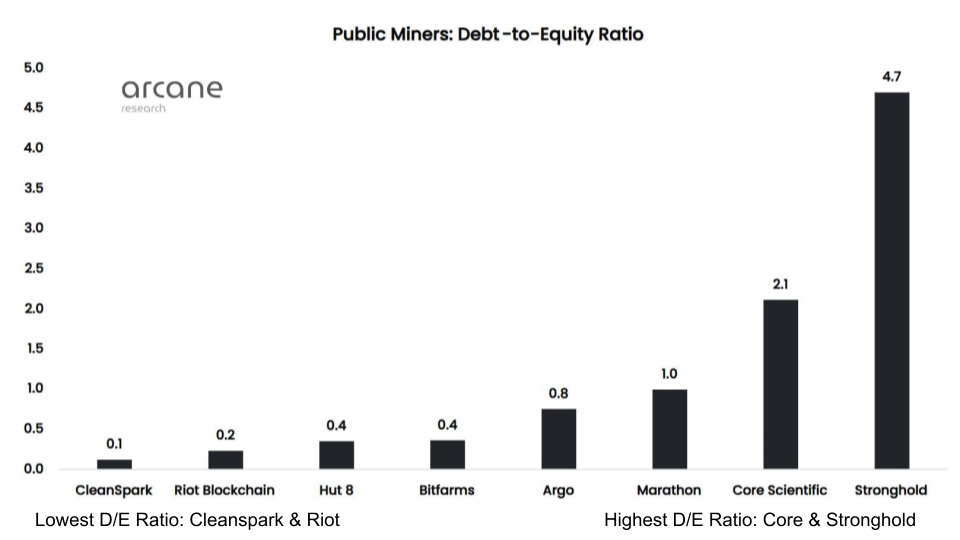

Finally, let’s review the debt to equity ratio for public mining farms. We can deduce that Cleanspark and Riot have the least debt to equity whereas Core & Stronghold are approximately 2-4x in debt compared to current equity.

Conclusion

- Argo & Cleanspark have the strongest balance sheet. Low debt, strong operating cash flows relative to upcoming machine payments. Low BTC production cost too.

- Riot is in a good position based on cash flow & balance sheet. Substantial upcoming miner payments but they should be able to generate cash flow by plugging them in ASAP.

- Marathon is the weakest miner. Strong balance sheet with lots of cash but massive upcoming machine payments will drain liquidity. Most likely will be forced to sell BTC or machine orders.

- Odds are stacked against Stronghold surviving. Grid prices rising with low liquidity, high chance of selling ASICs & focusing on power generation.

Source:

Arcane Research, Survival of the fittest: Which public bitcoin miners are the best prepared to survive the bear market?, Jason Mallory, accessed 28th June 2022, <https://arcane.no/research/survival-of-the-fittest-which-public-bitcoin-miners-are-the-best-prepared-to>.