Every Thursday, as part of our ongoing Throwback Thursday series, we take a closer look at the past within the cryptoverse to reflect on history, gain valuable insights, and educate the community. Today, we examine the persistent fascination with altcoin ASIC miners, a phenomenon that has intrigued newcomers and cautioned experts. These miners, known for promising substantial returns, are often the first choice for those beginning their mining journey. However, as we will see, their allure often masks a more complex and less rewarding reality.

The Newcomer’s Dilemma: The Illusion of Quick Profits

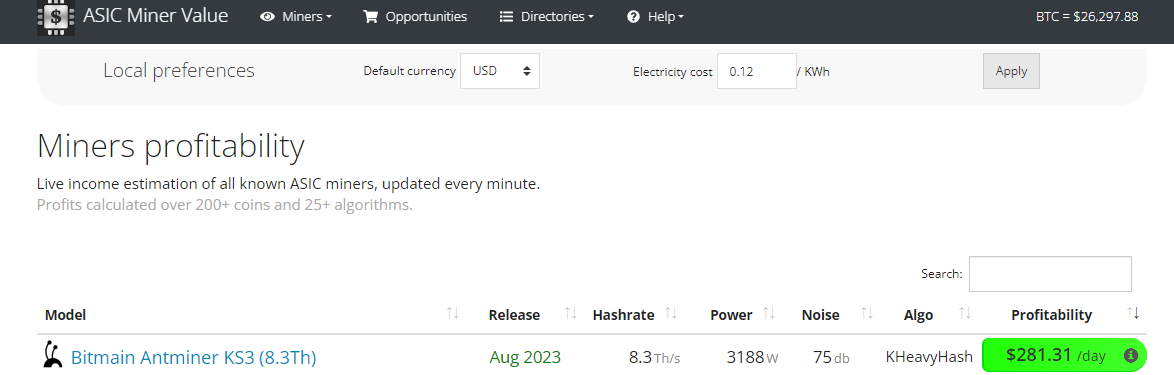

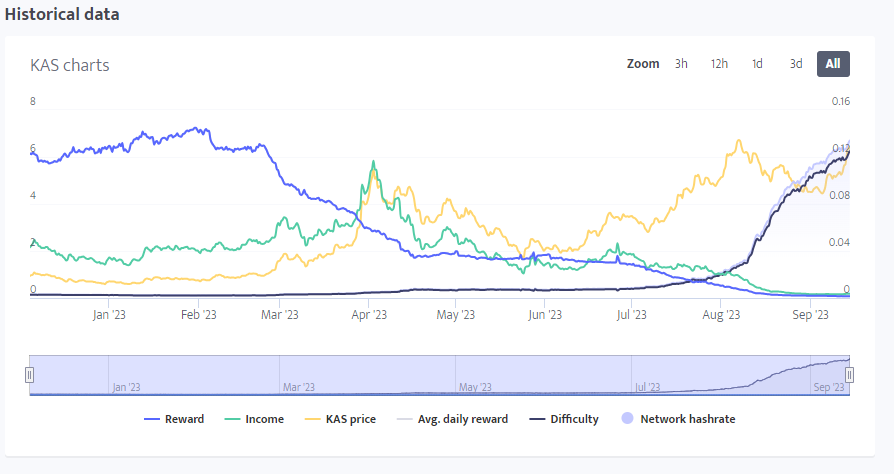

As individuals enter the world of mining, websites like Asicminervalue and Whattomine offer a glimpse of potential profitability. At first glance, an altcoin ASIC miner often appears as the most appealing option, promising exceptional daily returns. However, a closer look at historical data reveals a different story: initial high profitability that quickly diminishes.

Altcoin ASIC miners are frequently marketed as the path to quick wealth, but their history is characterized by short-lived prosperity. These machines, initially appearing as the most profitable mining choice, can quickly lead to disappointment. The promise of daily returns that dazzles newcomers often fades, and achieving ROI becomes challenging, if not impossible. This cycle of high expectations followed by financial letdowns is a recurring theme in the world of altcoin ASIC mining.

Kaspa and Kadena: Lessons from Two Altcoins

Looking at the experiences of Kaspa and Kadena, two altcoins that were once popular among every day miners, provides valuable insights. These altcoins started as GPU-mined assets, offering decentralization and profitable mining for individuals. However, the arrival of ASIC miners altered their trajectory. While these ASICs brought efficiency and power, they also led to rapid centralization. The dream of individual miners earning substantial rewards soon gave way to a more sobering reality of diminished profitability.

Manufacturers’ Profit Pursuit: The ASIC Pre-Mining Predicament

Manufacturers, sensing the potential for profit, often develop ASIC miners tailored for GPU mined altcoins. But before these miners reach the hands of the public, manufacturers often engage in pre-mining. This not only floods the market with coins, reducing their value but also increases mining difficulty. By the time individual miners get their hands on these ASICs, profitability has often plummeted. The decentralized dream quickly turns into a centralized reality. The development teams and communities of a few altcoins choose to upgrade their algorithms to be ASIC resistant in order to avoid this from happening, but they are few and far between.

My Bitmain D3 Experience: A Personal Journey with Dash

Reflecting on my personal mining endeavor with Dash and Bitmain D3’s in 2017 underscores the stark realities. Attracted by the promise of a 1 month ROI at $3,000 in monthly returns from mining Dash using the D3, my initial excitement was palpable. However, as my D3s arrived, the landscape had transformed significantly. The once-promising returns dwindled until finally it was unprofitable to mine and I never recouped my investment. Unfortunately, my own experience in 2017 mirrors the broader narrative for altcoin ASICs to this day. One only has to look at the altcoin ASIC graveyard by seeing the bottom of each page on Asicminervalue to see where these miners are deemed to fall.

Bitcoin: A Beacon of Stability with Long-Term Value

On the other hand, Bitcoin stands as a stable anchor in the mining industry. Its inherent decentralization, combined with predictable events such as halvenings, offers a sense of stability and predictability. Bitcoin’s appeal lies in its stability, liquidity and potential as a store of value. It’s window of opportunity is much wider. While altcoin ASIC miners often struggle to maintain profitability over time, Bitcoin miners typically experience a more predictable journey. The resale value of tried and tested Bitcoin ASICs also remain high, allowing miners to recoup their investments and, in many cases, even turn a profit that they can use to upgrade to the latest and most efficient machines. This allows miners to take advantage of the miner life cycle to not only ROI, but to create multiple cycles of profits. It’s no wonder that institutional level mining primarily concentrates on Bitcoin mining.

Guidance for Newcomers

For those entering the mining arena, caution should be their guiding principle. Navigating the mining landscape requires a balanced and informed approach. While altcoin ASIC miners may appear tempting at first, it’s essential to recognize their historical pattern of high paper profits that often diminish by the time the miner is public. Bitcoin, with its stability and predictable performance presents a reliable path to success in the mining industry. The recommended guidance is to concentrate most of your resources to Bitcoin mining while allocating 5-10% towards speculatively mining altcoins.

As we conclude this Throwback Thursday reflection, the lessons are clear. The world of altcoin ASIC miners, while alluring, is a mirage. Stay tuned with the latest industry updates by following our daily blog. And for those just beginning their mining journey or experienced miners, AsicZ.com stands ready to equip you with a wide range of Bitcoin miners and our industry leading MaaS (Mining as a Service). With power rates under .03/kWh that keep you profitable under most market conditions, we’re here to ensure your success.

References

- Linkedin Post

- ASIC Miner Value

- Kaspa’s Transition to ASIC Mining

- Kadena’s Mining Evolution

- The Rise and Fall of Altcoin ASIC Miners

- Minerstat