Welcome to this week’s Throwback Thursday article, where we look back to a significant event in the history of the crypto industry – the rise and fall of Mt. Gox. In this detailed article, we will explore the journey of Mt. Gox, from its humble beginnings as a Bitcoin exchange to its infamous collapse. Join us as we unravel the lessons learned from this pivotal event and its impact on the crypto ecosystem.

The Birth of Mt. Gox:

Mt. Gox, short for “Magic: The Gathering Online Exchange,” was initially established in 2009 as a platform for trading Magic: The Gathering cards. It was in 2010 that the exchange underwent a transformative shift, when Jed McCaleb, a prominent figure in the early crypto community, took over the platform and repurposed it to facilitate Bitcoin trading. Under McCaleb’s leadership, Mt. Gox quickly became the go-to exchange for Bitcoin enthusiasts around the world.

The Dominance of Mt. Gox:

During its peak, Mt. Gox dominated the Bitcoin exchange landscape, handling an estimated 70% to 80% of all Bitcoin transactions globally. Its easy-to-use interface, liquidity, and availability of trading pairs attracted a significant user base, establishing Mt. Gox as the leading exchange in the nascent crypto industry.

Challenges and Controversies:

As Mt. Gox experienced rapid growth, it also encountered its fair share of challenges and controversies. Operational issues, including trading glitches and security vulnerabilities, began to surface, leading to intermittent service disruptions and user frustrations. Moreover, the exchange faced increasing scrutiny from regulatory authorities regarding its compliance practices and the handling of customer funds.

The Mt. Gox Hack and Downfall:

The turning point for Mt. Gox came in February 2014 when the exchange announced the loss of approximately 850,000 Bitcoins, valued at that time around $450 million or about $23 billion today. It was later revealed that the loss was the result of a prolonged series of security breaches and insolvency issues. The incident shattered confidence in Mt. Gox and sent shockwaves throughout the community.

Aftermath and Legal Proceedings:

In the aftermath of the hack, Mt. Gox filed for bankruptcy protection, leaving thousands of users in limbo with their funds frozen. Legal proceedings ensued, and investigations uncovered mismanagement, inadequate security measures, and alleged fraudulent activities within the exchange. The collapse of Mt. Gox highlighted the need for improved regulatory frameworks and heightened security standards within the industry.

Lessons Learned and Industry Impact:

The Mt. Gox incident served as a wake-up call for the entire ecosystem. It underscored the importance of robust security practices, transparent governance, and adequate safeguards for customer funds. The industry, regulators, and market participants collectively recognized the need to implement stricter standards and develop secure infrastructure to protect the interests of users and foster trust.

The Legacy of Mt. Gox:

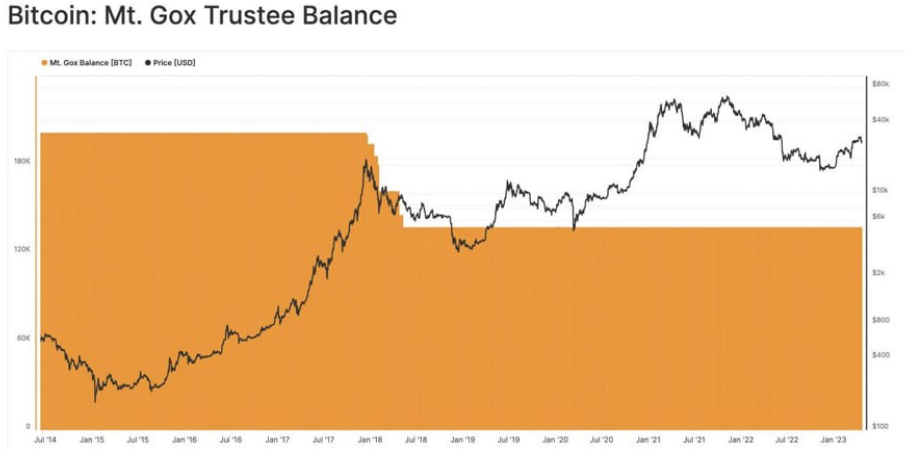

According to recent reports, the Mt. Gox trustee currently holds approximately 137,890 Bitcoins, which is equivalent to over $10 billion in crypto at prevailing market prices as can be seen in the chart from Glassnode below. This substantial amount of Bitcoin has piqued the curiosity of investors, who closely monitor any potential movement or release of these funds to affected users. The anticipation surrounding the Mt. Gox wallets stems from the uncertainty of when and how the coins will be released into the market.

If a significant amount of Bitcoin from the Mt. Gox wallets were to be liquidated or transferred, it could have implications for the overall BTC price. Such large-scale transactions have the potential to impact market dynamics and investor sentiment. When substantial quantities of Bitcoin are introduced into the market, it often triggers price fluctuations and heightened volatility. The sheer size of the Mt. Gox holdings means that any movement of these coins could have a noticeable effect on the BTC price.

Investors, therefore, keep a close eye on developments related to the Mt. Gox trustee and their handling of the Bitcoin holdings. The manner in which these coins are released—whether through gradual sell-offs, auctions, or other methods—will be crucial in determining the potential impact on the BTC market. Market observers and analysts closely analyze these situations, attempting to predict the possible outcomes and adjust their investment strategies accordingly.

It is worth noting that the industry has evolved significantly since the Mt. Gox incident, with improved security practices and regulatory frameworks in place. However, the sheer size of the Mt. Gox holdings, combined with the historical significance of the exchange’s collapse, continues to make its impact on the market an important consideration for investors. The handling of these funds by the Mt. Gox trustee and any subsequent market movements will be closely monitored.

At AsicZ, we understand the importance of learning from the past while embracing the future. As a trusted provider of volume mining hardware and competitive hosting solutions, we are committed to empowering miners and investors with the tools and knowledge they need to navigate the crypto landscape securely.

Whether you’re a seasoned miner or a crypto enthusiast looking to enter the market, AsicZ offers a range of mining hardware options and hosting services tailored to your needs. Our team of experts is dedicated to helping you optimize your operations, maximize profitability, and safeguard your digital assets.

Visit AsicZ.com today to explore our offerings and take your crypto journey to new heights. For personalized guidance and support, feel free to reach out to us directly at team@asicz.com.